|

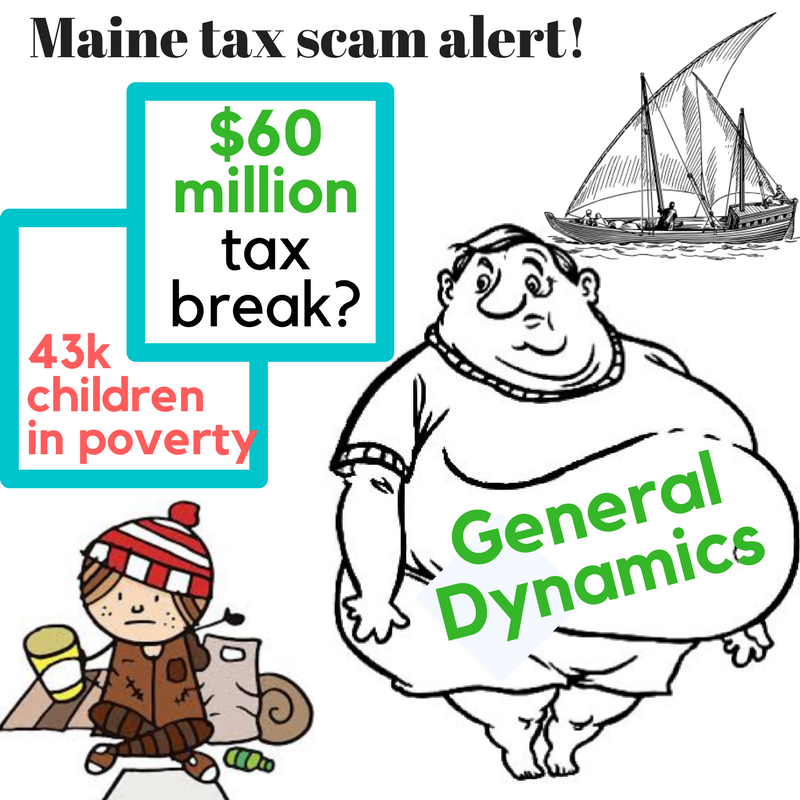

| Not only Congress but also the Maine Legislature is pressured by General Dynamics to provide tax relief. Maine Democrats Rep. Jennifer DeChant and Sen. Eloise Vitelli are sponsoring a bill to give GD $60 million from state coffers this year — because servicing corporations is a thoroughly bipartisan affair. |

Maine’s senators are wealthy people. Senator Susan Collins has just sent me a long email explaining why I should be delighted that she helped pass a tax bill that 78% of her constituents responding to a poll in the Bangor Daily News said will not benefit them.

Most of us allegedly represented by Collins are not at all wealthy, and her claim that we will benefit under the new tax laws is only true in the very short term.

Long term, the already wealthy will become much, much wealthier. In Collins’ letter these are known as employers, and she is proud of talking to them:

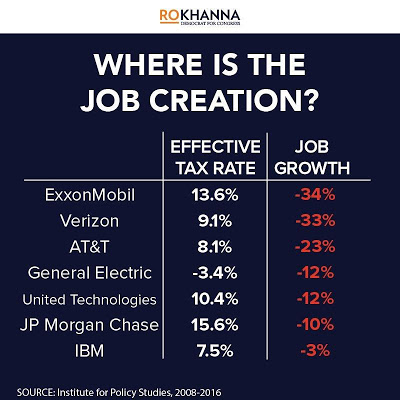

How the legislation treats employers has been the subject of much debate, but the reality is that the United States cannot continue to have the highest corporate tax rate in the world at 35 percent. We are losing jobs. I talked to General Dynamics, which owns Bath Iron Works; United Technology, which employs over 1,900 people at Pratt & Whitney in North Berwick; General Electric, which has a major plant in Bangor; Procter & Gamble, which employs 400 workers in Auburn; and Idexx, an important high-tech employer in Westbrook, about the positive difference the new law will make in their ability to create jobs in Maine. Indeed, on the day Congress sent the bill to the President, Cianbro Corporation announced it intends to hire an additional 300 people next year.

|

(“Talking” here means finding out what they want her to do in exchange for massive campaign contributions these corporations have and will continue to make.) |

| Graph from a Providence Journal article by Alex Nunes “Defense firms spend big on lucrative stock buybacks” 12/3/17 |

Maine is indeed losing jobs, because corporations like General Dynamics use their extra cash from tax relief to buy back their own stock and to provide massive salaries and bonuses to their CEOs. They do not use tax relief to create jobs (nor are they paying taxes at 30%) despite their claims to the contrary.

Mainer Michael Anthony calculated that “$60 million in proposed tax cuts is the equivalent of rewarding BIW $375,000 for every job they cut last year.”

I spent the day in Sagadahoc County court yesterday with my trial family, the Aegis 9, who were arrested last April protesting at BIW. We stood nonviolently with our messages intended for senators and other dignitaries being whisked through the gates in limousines, and as a result were charged with criminal trespass. Our messages were not allowed into the public relations event “christening” another warship that the U.S. does not need, while 43,000 children in Maine are living in poverty.

I could take my concerns to Maine’s other senator, the allegedly moderate, independent Angus King.

But I have to work. Also, this school teacher doesn’t have $1,000 to take a “really inexpensive cruise” with the senator and his corporate cronies.

The organizer of Senator King’s fundraising event also brags on his website about his skill in “talking” to lawmakers, because this is how the sausage gets made in Washington.

But who opens doors for the approximately 20,000 Maine children in deep poverty currently enduring weeks of subzero temperatures?

For this reason, and so many more: